In today’s fast-paced world, generating passive income from real estate investment in Nepal has become an increasingly attractive option for achieving financial freedom. With Nepal’s booming real estate market, fueled by rapid urbanization, rising remittances, and government incentives, the potential for consistent and reliable income streams is stronger than ever. This guide delves into the intricacies of earning passive income through real estate in Nepal, offering insights into strategies, market trends, economic impacts, and practical tips for success.

By exploring rental properties, Real Estate Investment Trusts (REITs), vacation rentals, and property flipping, we’ll uncover how investors can capitalize on Nepal’s growing property market. Additionally, we’ll highlight research from authoritative sources, provide real-world case studies, and include actionable advice to ensure your investments thrive in Kathmandu, Lalitpur, Pokhara, and beyond. Let’s dive in and discover how you can build wealth through passive income from real estate investment in Nepal!

Why Real Estate is a Prime Choice for Passive Income in Nepal

Real estate stands out as a dependable source of passive income due to its stability and potential for long-term appreciation. Unlike volatile investments like stocks, real estate in Nepal offers tangible assets that generate consistent cash flow through rentals or capital gains.

According to a 2024 study by Chandra Prasad Dhakal, real estate accounts for approximately 90% of national properties in Nepal, underscoring its dominance in the economy. The sector’s growth is driven by:

- Rapid Urbanization: Cities like Kathmandu, Lalitpur, and Bhaktapur are experiencing a surge in demand for residential and commercial properties due to population growth and urban migration.

- Rising Remittances: Nepal’s economy benefits from substantial remittance inflows, with the World Bank reporting a 15.5% increase in remittances in 2024, much of which is invested in real estate.

- Government Policies: Initiatives like the Nepal Housing Development Finance Company and relaxed regulations for non-resident Nepalese (NRNs) encourage property investment.

Transitioning to the specifics, let’s explore the key strategies for generating passive income from real estate investment in Nepal, supported by research and practical examples.

Key Strategies for Generating Passive Income from Real Estate Investment

1. Rental Properties: A Steady Income Stream

Rental properties are the cornerstone of passive income from real estate investment in Nepal. By purchasing residential or commercial spaces and leasing them out, investors can secure monthly rental income with minimal ongoing effort. Research highlights that Nepal’s real estate market has seen steady growth since the 1980s, with high-demand areas like Kathmandu and Lalitpur offering strong rental yields due to limited land availability.

Why Rental Properties Work in Nepal

- High Demand: Urban centers like Kathmandu, Lalitpur, and Pokhara have a growing need for housing, driven by students, professionals, and tourists.

- Adjustable Rents: Investors can adjust rent prices over time to align with market trends, ensuring consistent returns.

- Multi-Unit Properties: Investing in apartment buildings or multi-family homes allows for multiple income streams from a single property, reducing vacancy risks.

Case Study: Kathmandu’s Thamel Rental Market

In Thamel, a bustling tourist hub, a 3BHK apartment (1500 sq. ft.) purchased for NPR 2.5 crore in 2023 generates monthly rental income of NPR 80,000–100,000. With a 5–6% annual rental yield, the investor recovers their investment over 15–20 years while benefiting from property appreciation. The property’s proximity to tourist attractions ensures consistent demand, even during economic fluctuations.

Tips for Success

- Choose Strategic Locations: Focus on areas near universities (e.g., Tribhuvan University), business districts (e.g., Durbar Marg), or tourist spots (e.g., Lakeside, Pokhara).

- Screen Tenants: Use clear rental agreements and vet tenants to ensure reliable payments.

- Hire Property Managers: For hands-off management, professional services can handle maintenance and tenant issues, making the income truly passive.

2. Real Estate Investment Trusts (REITs): Hands-Off Investing

For investors seeking passive income from real estate investment in Nepal without the hassles of property management, Real Estate Investment Trusts (REITs) are an excellent option. REITs allow individuals to invest in a portfolio of properties, earning dividends from rental income or property sales. Although still emerging in Nepal, REITs are gaining traction as a low-maintenance investment vehicle.

Benefits of REITs in Nepal

- Low Entry Barrier: Investors can start with smaller capital compared to direct property purchases.

- Diversification: REITs spread investments across multiple properties, reducing risk.

- No Management Required: Investors avoid tenant issues, maintenance, or legal complexities.

Case Study: Nepal’s Emerging REIT Market

In 2024, the Nepal Housing Development Finance Company launched a pilot REIT program targeting commercial properties in Kathmandu. Investors contributing NPR 1 lakh received quarterly dividends averaging 4–5% annually, based on rental income from office spaces in Baneshwor. This hands-off approach appeals to NRNs and local investors seeking passive income without direct involvement.

Tips for Success

- Research REIT Providers: Partner with reputable developers like Karyabinayak Homes or government-backed initiatives for reliability.

- Monitor Market Trends: Stay informed about REIT performance and property demand in urban areas.

- Consult Financial Advisors: Ensure the REIT aligns with your financial goals and risk tolerance.

3. Vacation Rentals: Capitalizing on Tourism

Nepal’s thriving tourism industry, contributing significantly to GDP, makes vacation rentals a lucrative source of passive income from real estate investment in Nepal. Platforms like Airbnb have revolutionized short-term rentals, offering higher returns than long-term leases, especially in tourist hotspots like Thamel, Lakeside (Pokhara), and Sauraha (Chitwan).

Why Vacation Rentals Excel

- High Returns: Short-term rentals can yield 8–12% annually, compared to 5–6% for long-term rentals.

- Tourist Demand: Nepal welcomed over 1.2 million tourists in 2024, driving demand for vacation homes.

- Flexibility: Owners can use properties personally during off-seasons, blending lifestyle and investment benefits.

Case Study: Lakeside, Pokhara Vacation Rental

A 2BHK villa in Lakeside, Pokhara, purchased for NPR 1.8 crore in 2022, generates NPR 4,000–6,000 per night on Airbnb, averaging 20 booked nights per month. This translates to NPR 80,000–120,000 monthly, offering a 6–8% annual yield. The property’s proximity to Fewa Lake and adventure activities ensures year-round bookings, even during economic downturns.

Tips for Success

- Optimize Listings: Use professional photos and detailed descriptions to attract guests.

- Leverage Platforms: Promote on Airbnb, Booking.com, or local platforms like SastoDeal for maximum visibility.

- Ensure Amenities: Provide Wi-Fi, hot water, and modern furnishings to appeal to international tourists.

4. Property Flipping: Active to Passive Income

While less passive than rentals or REITs, property flipping—buying, renovating, and selling properties at a profit—can generate significant income with strategic planning. In Nepal, flipping is viable in areas with rising property values, such as Bhaktapur and Lalitpur.

Why Flipping Works

- High Profit Margins: Renovated properties in urban areas can yield 20–30% returns upon resale.

- Market Growth: Property prices in Kathmandu have risen by 15% annually in high-demand areas.

- Renovation Opportunities: Older properties in Bhaktapur or Balkot offer potential for value-adding upgrades.

Case Study: Bhaktapur Flipping Success

In 2023, an investor purchased a fixer-upper in Bhaktapur for NPR 1.5 crore, invested NPR 30 lakh in renovations (modern interiors, earthquake-resistant upgrades), and sold it for NPR 2.2 crore within a year. The 30% profit margin highlights the potential of flipping in Nepal’s cultural hubs, where demand for heritage-inspired homes is strong.

Tips for Success

- Conduct Feasibility Studies: Analyze location, renovation costs, and resale potential before purchasing.

- Focus on High-Demand Areas: Target Bhaktapur, Bijeshwari, or Nilbarahi for cultural and economic appeal.

- Work with Experts: Collaborate with local contractors and real estate agents to streamline renovations and sales.

Table: Comparison of Passive Income Strategies in Nepal

| Strategy | Initial Investment | Annual Yield | Effort Level | Best Locations | Risk Level |

|---|---|---|---|---|---|

| Rental Properties | NPR 1–3 crore | 5–6% | Low–Medium | Kathmandu, Lalitpur, Pokhara | Low |

| REITs | NPR 50,000–5 lakh | 4–5% | Very Low | Urban commercial hubs | Low–Medium |

| Vacation Rentals | NPR 1–2 crore | 8–12% | Medium | Thamel, Lakeside, Sauraha | Medium |

| Property Flipping | NPR 1–2 crore | 20–30% | High | Bhaktapur, Balkot, Bijeshwari | Medium–High |

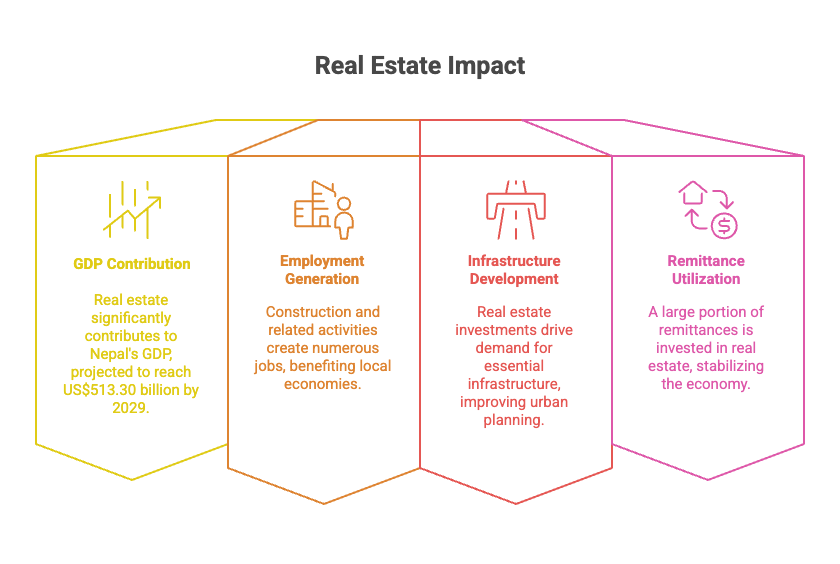

Economic Impacts of Real Estate Investment in Nepal

Real estate is a cornerstone of Nepal’s economy, contributing significantly to GDP, employment, and infrastructure development. A study notes that real estate influences nearly all economic activities in Nepal, driven by traditional property concepts, global influences, remittances, and government policies. Here’s how real estate investments impact Nepal’s economy:

- GDP Contribution: The real estate sector accounts for a substantial portion of Nepal’s GDP, with a projected market volume of US$513.30 billion by 2029, growing at 3.12% annually (2025 to 2029).

- Employment Generation: Construction and related activities create jobs for thousands, from laborers to architects, boosting local economies.

- Infrastructure Development: Investments in real estate drive demand for roads, utilities, and public facilities, enhancing urban planning.

- Remittance Utilization: A significant portion of Nepal’s remittances (15–20% of GDP) is channeled into real estate, stabilizing the economy.

However, challenges like liquidity constraints, high land prices, and regulatory inconsistencies can hinder returns. A 2024 research highlights behavioral biases like over-optimism and herd mentality, which can lead to speculative bubbles in Nepal’s real estate market, necessitating cautious investment strategies.

Challenges and Risks in Nepal’s Real Estate Market

While the potential for passive income from real estate investment in Nepal is high, investors must navigate several challenges:

- High Land Prices: In Kathmandu, land prices within the Ring Road are often unaffordable, with plots costing NPR 25–70 lakh per aana.

- Liquidity Issues: Real estate’s limited liquidity compared to stocks can tie up capital for years.

- Economic Volatility: Crises, such as the 2015 earthquake or COVID-19, can disrupt demand and prices.

- Regulatory Hurdles: Inconsistent policies and bureaucratic delays can complicate property transactions.

Mitigating Risks

- Conduct Thorough Research: Study market trends, legal requirements, and property valuations before investing.

- Diversify Investments: Combine real estate with other assets like REITs or stocks to balance risk.

- Partner with Experts: Work with reputable developers like Aabran Villas or Karyabinayak Homes to ensure quality and compliance.

Investing in Aabran Villas: A Premium Passive Income Opportunity

Aabran Villas, a luxurious 12-storey residential complex in Gyaneshwor, Kathmandu, offers a unique opportunity for passive income from real estate investment in Nepal. Designed by Sanjay Puri, one of the world’s top 100 architects, this boutique living development features 18 exclusive units with imported Indian furnishings, a stunning façade, and premium amenities like rooftop jacuzzis and an infinity pool. Here’s how investing in Aabran Villas can generate passive income:

Why Aabran Villas Stands Out

- Premium Location: Located in Gyaneshwor, a sought-after neighborhood with property prices ranging from NPR 50–70 lakh per aana, Aabran Villas ensures high rental demand from professionals and expatriates.

- Luxury Appeal: Units like the 4BHK duplex penthouse (4566 sq. ft.) with private terraces attract high-net-worth tenants, commanding premium rents monthly.

- Low Maintenance: Built with earthquake-resistant techniques and sustainable materials, the complex minimizes upkeep costs, enhancing net rental income.

- Tourist Potential: Gyaneshwor’s proximity to Thamel and cultural sites makes short-term rentals viable, yielding 8–10% annually.

Tips for Success

- Target Corporate Tenants: Market to professionals or diplomats seeking luxury rentals in Gyaneshwor.

- Leverage Amenities: Highlight features like the infinity pool, fitness center, and private jacuzzis to attract premium tenants.

- Engage Property Managers: Use professional services to handle leasing and maintenance for a hands-off experience.

Conclusion

Generating passive income from real estate investment in Nepal offers a pathway to financial stability and long-term wealth. Whether through rental properties, REITs, vacation rentals, or flipping, Nepal’s real estate market presents diverse opportunities fueled by urbanization, remittances, and government support. By choosing strategic locations, leveraging professional services, and mitigating risks, investors can unlock consistent cash flows and capital appreciation.

With the market projected to grow to US$513.30 billion by 2029, now is the time to act. Start your journey today by exploring opportunities with trusted developers like Aabran Villas or Karyabinayak Homes, and build a legacy of wealth in Nepal’s vibrant real estate landscape!

Read More: How Aabran Villas Brings Resort-Style Living to Your Doorstep