When buyers weigh international options, Dubai often appears as the “shiny” choice: global city, modern infrastructure, investor-friendly rules, and high liquidity. Conversely, Nepal and cities like Kathmandu promise cultural proximity, lower entry-costs for locals, and rising urban demand. This article compares owning apartment in Dubai vs Nepal holistically, so you can decide which suits your goals: capital appreciation, rental income, lifestyle, or legacy ownership.

Price & Yield: Owning Apartment in Dubai Vs Nepal

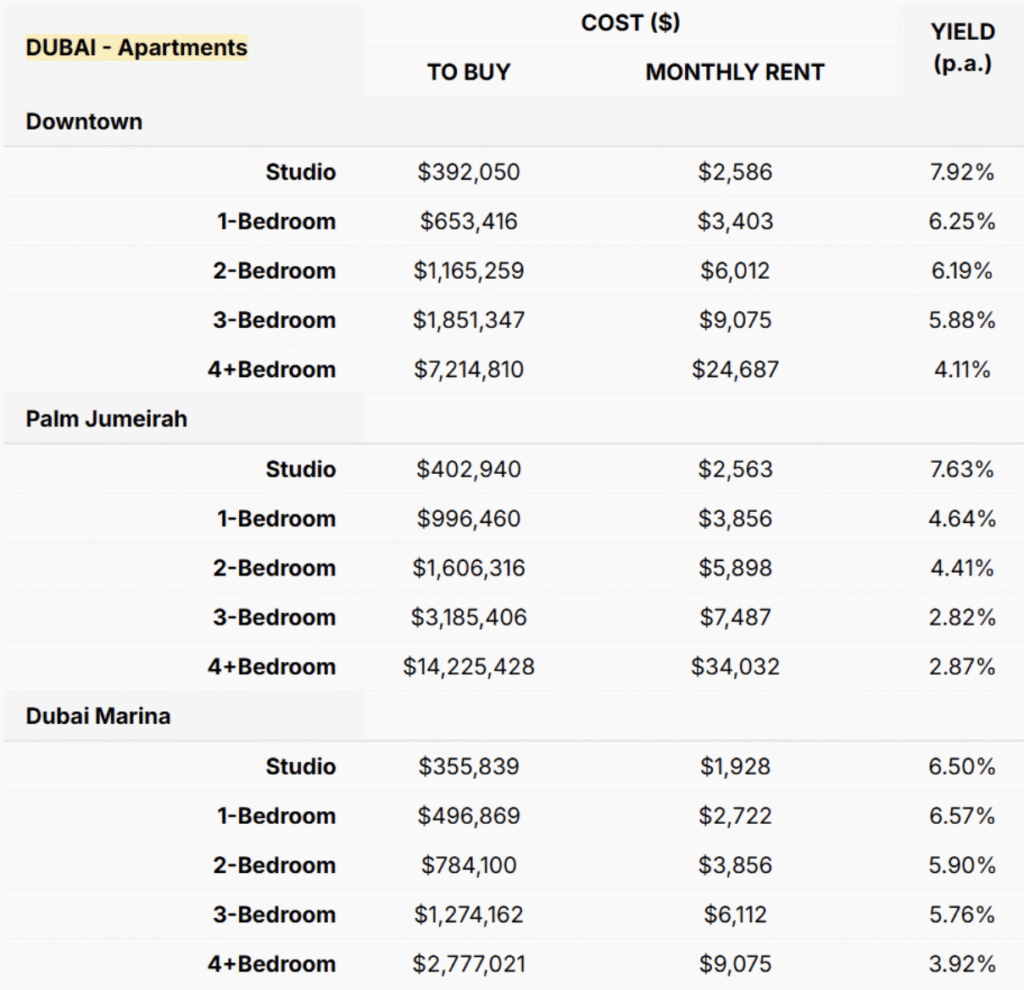

Property markets are heterogeneous prices vary by neighborhood, building class (luxury vs standard), and whether a unit is off-plan or ready. Below are representative ranges (compiled from market reports and local portals).

| Item | Dubai | Kathmandu / Nepal |

|---|---|---|

| Average prime apartment price (per sq.ft) | ~AED 1,100–1,750 / sq.ft in many prime areas (large variance by district; premium towers higher). | NPR 20,000–100,000 / sq.ft depending on location (prime corridors like New Road, Durbar Marg much higher). Local listings show wide spread. |

| Typical purchase price for a 2–3 BHK | USD ~250k–600k+ (varies) | NPR ~0.6 Cr – 6 Cr+ for central Kathmandu apartments, depending on size and location. |

| Typical gross rental yield (apartments) | ~4–6% for many areas; top investor-grade assets can vary. Knight Frank & market reports show yields around mid-single digits. | ~5–9% in targeted rental hotspots (some pockets report 5–6% typical; high-yield micro-markets can reach higher). Local reports vary. |

| Transaction costs / closing fees | DLD transfer fee (~4%), agent fees, developer charges; financing available with regulated mortgages. | Registration fees, taxes, stamp duty and miscellaneous local charges; mortgage market smaller and more conservative. |

Takeaway: Dubai’s absolute prices are higher, but yields are competitive; Kathmandu offers lower entry prices for local buyers and pockets of attractive yields provided you target the right area and product.

Legal rules & Apartment Ownership: Nepal Vs Dubai

When comparing apartment Dubai vs Nepal, understanding ownership laws is crucial because the legal framework directly shapes your rights, investment security, and ease of resale.

Key Legal Frameworks: Apartment Ownership in Nepal

Unlike Dubai, where property ownership is governed by international-standard real estate regulations and freehold laws for foreigners in designated zones, Nepal’s apartment ownership falls under several key acts and regulations:

- Condominium Ownership Act, 2054 (1997): The primary law governing apartment ownership in Nepal. It outlines the rights and responsibilities of both owners and developers, including how common areas should be managed.

- Condominium Rules, 2056: Provides detailed guidelines for the operation, management, and maintenance of apartments, ensuring clarity on usage of shared facilities such as parking, elevators, and gardens.

- Muluki Civil Code, 2074: Addresses property rights comprehensively — including ownership, inheritance, transfer of property, and remedies in case of disputes.

- Property Registration Act: Defines the procedures for registering property transactions. Proper registration at the Land Revenue Office is essential for ownership rights to be legally valid.

- Local Self-Governance Act: Empowers local municipalities to approve building plans, regulate urban development, and ensure housing projects comply with safety and zoning rules.

In Nepal

- Direct property ownership is limited primarily to Nepali citizens. Foreign nationals cannot directly buy land or apartments in their own name.

- However, Non-Resident Nepalis (NRNs) are allowed to purchase apartments and own property under the NRN Act, provided they follow registration and documentation requirements.

- For foreign nationals, property purchase is typically possible only through long-term leasehold arrangements or special structures (like joint ventures with Nepali entities).

- Land records and registration are handled through local government offices, and due diligence on titles (Lal Purja) is essential before buying.

- While Nepal does not offer direct residency rights tied to property investment (unlike Dubai), local buyers benefit from strong cultural and familial incentives to keep property within the community.

Key Legal Frameworks: Apartment Ownership in Dubai

Dubai has one of the most structured and investor-friendly legal frameworks for real estate in the region. These laws and entities ensure transparency, protect buyers, and regulate developers.

- Federal Law No. 27 of 2007 (and amendments): Often referred to as the Strata Law, it provides the foundation for real estate ownership, defining property rights, including ownership of individual units and shared common areas.

- Law No. 26 of 2007: Governs landlord-tenant relationships, ensuring fairness in rental agreements and outlining both landlord and tenant obligations.

- Dubai Land Department (DLD): The central government authority responsible for overseeing and recording all property transactions. It manages registration, transfer of titles, and collection of transfer fees.

- Real Estate Regulatory Agency (RERA): The regulatory arm of the DLD that enforces real estate laws. RERA oversees developers, brokers, and escrow accounts for off-plan projects, protecting buyers against fraudulent practices.

- Ownership Types:

- Freehold Ownership: Grants full and indefinite rights over the property and land. Foreigners can buy freehold property in designated zones (e.g., Dubai Marina, Downtown, Palm Jumeirah), giving them permanent rights to sell, lease, or bequeath their property.

- Leasehold Ownership: Grants property rights for long-term leases (typically 10–99 years). At the end of the lease, ownership reverts to the freeholder unless extended.

In Dubai

- Foreigners are allowed to purchase apartments in designated freehold zones such as Downtown Dubai, Dubai Marina, and Palm Jumeirah.

- Ownership is registered with the Dubai Land Department (DLD), giving buyers full rights to sell, lease, or pass the property to heirs.

- Long-term residency incentives such as the UAE Golden Visa are available for investors meeting certain property value thresholds, adding lifestyle and visa benefits alongside ownership.

- Buyers enjoy a transparent process with escrow accounts for off-plan purchases, mandatory developer registration, and strong consumer protections.

Liquidity & Market Depth

- Dubai: A deep, liquid secondary market with significant international buyer flows. The city’s liberal visa and residency incentives (e.g., Golden Visa programs) and strong international marketing make exit options comparatively easier. Market data (DLD, market reports) show rapid price growth and high transaction volumes in several periods.

- Kathmandu: Local market liquidity is more localized and relationship-driven. Prime pockets in Kathmandu (New Road, Durbar Marg, Thamel) are highly sought after, and apartments with strong demand (near hospitals, offices, universities) rent well; however, national policy, title clarity and buyer demographics make the market less internationally liquid than Dubai.

Taxes, Fees & Holding Costs: Dubai vs Nepal

Beyond purchase price, every apartment buyer must evaluate the hidden and recurring costs of ownership. These include registration fees, transfer taxes, service charges, and ongoing municipal levies. The structure differs significantly when comparing Dubai vs Nepal.

Owning Apartment in Dubai

- Transfer Fee: Buyers pay a 4% transfer fee to the Dubai Land Department (DLD) on property purchases. This is usually split between buyer and seller, though often negotiated.

- Agency Fees: Real estate agent commission is typically 2% of the purchase price, plus VAT.

- Oqood Registration Fee: For off-plan properties, an Oqood (contract registration) fee of AED 1,000 + admin costs applies.

- Service Charges: Owners pay annual service charges (per sq.ft) for building maintenance, amenities, security, and community facilities. Rates vary widely luxury towers can be expensive due to high-end amenities.

- Mortgage Registration Fee: For financed purchases, mortgage registration at DLD costs 0.25% of the loan amount + AED 290 admin fee.

- Holding Costs: Importantly, Dubai has no annual property tax and no capital gains tax for individuals, making holding long-term relatively cost-efficient. Owners primarily budget for service charges and utilities.

Owning Apartment in Nepal

- Registration & Stamp Duty: Property transactions attract a registration fee/stamp duty, usually around 4–6% of the property value, depending on location and local municipal rules.

- Capital Gains Tax: Sellers pay capital gains tax when disposing of property, typically around 5–10% of the profit margin (rates depend on property type and ownership duration). Buyers should factor this into resale scenarios.

- Value Added Tax (VAT): In some new apartment projects, VAT of 13% may apply on top of the base property price, especially for developer-built units.

- Service Charges: Modern apartments (like Newroad Heights or Aabran Villas) levy monthly/annual maintenance charges for lifts, security, parking, water supply, and shared amenities. These vary by project but are generally lower than Dubai’s luxury towers.

- Municipal & Utility Fees: Owners pay property-related municipal charges, waste management fees, and monthly utilities (water, electricity, internet).

- Holding Costs: Nepal does not levy an annual property tax in the Dubai sense, but ongoing municipal and service-related fees apply.

Key Contrast

- Dubai: Higher upfront fees (DLD transfer, agent commission) but low recurring taxes. Service charges can be steep in luxury developments but ownership is tax-light long-term.

- Nepal: Entry costs (registration/stamp duty) are comparable, but VAT on new builds and capital gains taxes on resale increase the effective cost. However, ongoing holding costs are relatively modest, especially for mid-scale apartments.

Takeaway: Dubai is attractive for long-term holders due to the absence of property and capital gains taxes, while Nepal is attractive for citizens and NRNs because upfront costs are manageable and running costs are relatively low compared to global benchmarks.

Financing & Interest Rates: Owning Apartment in Dubai vs Nepal

One of the biggest factors influencing apartment purchases is how easily buyers can access mortgages or loans. The financing landscape differs significantly between Dubai and Nepal, both in terms of availability and cost.

Dubai

- Mortgage Market Maturity: Dubai has a well-developed mortgage system regulated by the UAE Central Bank. Both residents and, in many cases, non-residents can access home financing.

- Loan-to-Value (LTV) Ratios:

- For first-time expatriate buyers, LTVs usually cap at 75% of the property value for properties under AED 5 million.

- For second properties, this typically reduces to 60%.

- UAE nationals often enjoy slightly higher LTVs.

- Interest Rates: Mortgage interest rates generally range between 3%–5% annually, depending on fixed vs variable products, borrower profile, and bank. Rates are linked to EIBOR (Emirates Interbank Offered Rate), so they fluctuate with global interest rate movements.

- Tenure: Loans can stretch up to 25 years, offering flexibility and affordability for buyers.

- Off-Plan Financing: Many developers also provide attractive post-handover payment plans for off-plan projects, allowing buyers to pay installments even after moving in — a strong draw for investors.

Nepal

- Conservative Mortgage Market: While commercial banks and financial institutions offer home loans, the market is much smaller and more conservative compared to Dubai.

- Loan-to-Value (LTV) Ratios: Banks typically finance up to 50%–70% of the property value for home loans, with stricter checks on income and repayment ability.

- Interest Rates: Mortgage rates are considerably higher than Dubai, often ranging between 10%–14% per annum, depending on the bank and market liquidity. Rates are influenced by the Nepal Rastra Bank’s monetary policies and domestic credit availability.

- Tenure: Loan terms usually extend up to 15–20 years, shorter than Dubai, which makes monthly repayments higher.

- Currency Factor: Loans are in Nepalese Rupees (NPR) only, which protects local buyers from forex risks but limits financing options for foreigners.

- NRN Considerations: Non-Resident Nepalis (NRNs) may access financing, but they often need additional documentation and local co-signers. For foreigners without NRN status, financing options are nearly non-existent, meaning purchases are typically cash-driven.

Key Contrast

- Dubai: Attractive for global investors due to lower interest rates, longer tenures, and high LTVs. Off-plan developer financing makes entry even easier.

- Nepal: Financing is more costly due to double-digit interest rates and shorter tenures, but for Nepali citizens and NRNs, it remains a feasible way to secure central properties. For foreign nationals, financing is minimal, making Nepal more of a cash-based market.

Takeaway: Dubai clearly wins on financing ease and affordability, while Nepal relies more on buyers with strong local financial capacity or cash reserves. However, rising property values in Kathmandu often compensate for the higher borrowing costs in the long run.

Construction Quality & Product Types

- Dubai: Large multinational developers, international standards, high-end fit-outs, and global branding. Off-plan offerings are common; buyers can select turnkey luxury finishes or invest in well-positioned ready units.

- Nepal: A mix of boutique developers and local builders. High-quality, design-driven boutique projects (e.g., Aabran Villas cited below) and professionally designed towers (Newroad Heights) are increasingly common. Developers often highlight seismic-resistant RCC structures and modern MEP specs in their brochures (see project spec examples).

Demand drivers: Who rents and buys?

- Dubai: Expatriates (corporate employees), HNWIs, global investors, and families seeking international schools and healthcare. Visa policy tweaks and employment demand directly influence rental markets. Bayut and dubizzle reports show strong rental pressure and growth in H1-2024 across segments.

- Kathmandu: Local professionals, returning NRNs, government/NGO staff, tourists (short-term in areas like Thamel), and students. Urbanization and growing services/tourism sectors underpin apartment demand in the valley. World Bank forecasts and local analyses point to ongoing urban growth and economic improvement as supporting demand.

Risks & Volatility: Owning Apartment in Dubai vs Nepal

Every property market carries risks, whether due to economic cycles, regulations, or local conditions. Understanding these is critical when comparing owning apartment Dubai vs Nepal for long-term investment.

Dubai

- Market Cyclicality: Dubai’s real estate is famous for boom-and-bust cycles. After rapid growth phases, prices have historically corrected sharply, especially during global crises (2008–2009, 2014–2016, and early pandemic). Investors need to be comfortable with short-term volatility.

- Oversupply Risk: With new mega-developments constantly announced, the risk of excess supply in certain districts (e.g., luxury towers in Marina or Downtown) can dampen rental yields and resale prices.

- Global Capital Dependence: Dubai is highly exposed to international buyers. Any global economic slowdown, oil price shocks, or changes in capital flows can directly impact demand.

- Regulatory Changes: While Dubai has strong governance through the Dubai Land Department (DLD), sudden policy shifts — like changes in mortgage caps or visa-linked ownership rules — can influence market sentiment.

- Currency Exposure: Properties are priced in AED (pegged to USD), which is stable, but buyers from weaker-currency countries may find affordability fluctuates with forex trends.

Nepal

- Political & Policy Instability: Nepal’s political environment can be unpredictable, with frequent government changes and policy shifts. This can affect real estate regulations, taxes, or approval processes.

- Foreign Ownership Restrictions: For foreign nationals, direct ownership is restricted, limiting liquidity and resale options compared to Dubai. This reduces the pool of international buyers.

- Title & Documentation Risks: In some areas, issues with land records (Lal Purja), encroachment disputes, or unclear titles can complicate transactions. Due diligence is essential.

- Infrastructure Gaps: While urban projects like Newroad Heights or Aabran Villas provide modern amenities, Nepal still faces infrastructure challenges (roads, utilities, waste management), which may affect overall property attractiveness.

- Natural Hazards: Nepal is a high seismic zone, making earthquake resilience a critical factor. Quality varies by developer, so buyers must ensure projects meet structural safety standards.

- Liquidity Constraints: Unlike Dubai’s deep market with global buyers, Nepal’s property transactions are slower and relationship-driven. Selling an apartment quickly at market value can be difficult without patience.

Key Contrast

- Dubai: Risks are primarily economic and market-driven price cycles, oversupply, and global capital dependency. But governance, transparency, and liquidity are strong.

- Nepal: Risks are more structural and policy-driven — ownership restrictions, political uncertainty, and infrastructure gaps. However, limited supply in prime Kathmandu areas often cushions against sharp downturns.

Takeaway: Dubai offers higher liquidity but sharper market swings, while Nepal offers slower but steadier appreciation, especially for citizens and NRNs. Risk in Nepal is more about governance and infrastructure, whereas in Dubai it’s about market cycles and external shocks.

Why Consider Buying Property in Nepal

If you’re comparing apartment Dubai vs Nepal from the perspective of a Nepali buyer, NRN, or regional investor, here are independent, positive reasons to pick Nepal — beyond sentimental ties:

- Lower nominal entry cost for local currency buyers. You can access central locations for less in absolute terms than Dubai’s prime towers.

- High relative land appreciation in urban pockets. Local project materials and market studies often cite strong land appreciation (some project literature estimates 12–15% annual appreciation in selected locations). brochure

- Strong local rental demand in targeted neighborhoods. Hospitals, universities and offices create steady tenant pools for well-located apartments.

- Cultural and legal ease for Nepali buyers / NRNs. Fewer cross-border tax, inheritance and residency complications for domestic buyers.

- Potential for higher yield micro-markets. Niche areas (student housing, tourist hubs) can produce yields competitive with international markets if managed well.

Practical Checklist for Buyers Comparing Dubai vs Nepal

If you’re weighing apartment Dubai vs Nepal, it helps to use a structured checklist before committing. This ensures you’re not just comparing prices, but also ownership rules, costs, and long-term potential.

1. Define Your Objective

- Are you buying for rental income, capital appreciation, lifestyle, or residency benefits?

- Dubai offers visa-linked property investment and high international rental demand.

- Nepal offers cultural proximity, legacy ownership, and central city convenience for citizens and NRNs.

2. Check Ownership Rules Early

- Dubai: Foreigners can buy freehold in designated zones; ownership is transparent and protected under Dubai Land Department (DLD) registration.

- Nepal: Citizens and NRNs can own apartments; foreigners (non-NRNs) face restrictions and often rely on leases or partnerships. Always verify Lal Purja (land ownership document) in Nepal.

3. Verify Developer & Project Credentials

- In Dubai, stick with RERA-registered developers and check escrow accounts for off-plan projects.

- In Nepal, choose established groups like RV Group (Aabran Villas, Newroad Heights) with a proven delivery record, ensuring earthquake-resistant construction and clear titles.

4. Compare Financing Options

- Dubai: Mortgages up to 75% LTV with 25-year tenures and 3–5% interest. Developers also offer flexible post-handover payment plans.

- Nepal: Banks usually finance 50–70% with higher interest (10–14%) and shorter tenures (15–20 years). NRNs may access financing with extra steps; foreigners often need cash purchases.

5. Calculate All Taxes & Fees

- Dubai: Factor in 4% DLD transfer fee, 2% agent fee, and annual service charges. No property or capital gains tax for individuals.

- Nepal: Budget for 4–6% registration/stamp duty, VAT on new units, and service charges. Sellers also face capital gains tax on resale.

6. Assess Risk & Liquidity

- Dubai: High liquidity, easy resale, but vulnerable to global shocks and oversupply.

- Nepal: Slower resale market, more localized demand, but supply scarcity in Kathmandu ensures long-term appreciation.

7. Evaluate Rental Potential

- Dubai: Strong expatriate demand, yields around 4–6%.

- Nepal: Rental demand from professionals, students, NGOs, and families; yields often 5–9% in prime areas.

8. Inspect Amenities & Infrastructure

- Dubai towers come with pools, gyms, concierge services; service charges are higher.

- Nepal’s modern projects (like Aabran Villas) now include swimming pools, gyms, EV-ready parking, landscaped gardens, with comparatively lower maintenance costs.

9. Consider Exit Strategy

- Dubai: Resale is straightforward through brokers and DLD channels.

- Nepal: Resale is slower; ideal if you’re buying for long-term holding or legacy value rather than quick flips.

10. Engage Professionals

- Always work with registered brokers, legal advisors, and banks.

- In Nepal, have a local lawyer verify documents; in Dubai, confirm through DLD-approved agents.

Final Verdict: Which should you buy?

There’s no single right answer for every buyer. However:

- If you are an international investor seeking instant freehold ownership, deep liquidity and global demand, Dubai is easier legally and operationally — but you’ll compete at higher price points and watch global cycles. UAE

- If you are a Nepali / NRN / regional investor who values cultural proximity, lower upfront cost (local currency), strong land scarcity in prime pockets, and the potential for solid local rental returns, Nepal (Kathmandu) offers compelling upside — provided you do title, developer and micro-market due diligence. Brochure-level projects such as Newroad Heights and boutique completed products like Aabran Villas illustrate the quality and positioning now available locally.

Why Aabran Villas Stands Out in Nepal?

Aabran Villas is more than just another premium apartment project in Kathmandu — it sets a new benchmark for boutique luxury living. With only 18 exclusive units, residents enjoy privacy and spacious 3 BHK layouts designed by world-renowned architect Sanjay Puri.

What truly makes Aabran special are its amenities: an indoor swimming pool, a state-of-the-art fitness center, rooftop jacuzzis, landscaped gardens, EV-ready covered parking, and high-speed elevators. Safety is prioritized through earthquake-resistant construction and 24/7 security with biometric access. Inside, the apartments feature imported finishes, modular kitchens, and designer bathrooms that elevate daily living.

Located in Gyaneshwor, a prime Kathmandu neighborhood close to hospitals, schools, and shopping hubs, Aabran Villas combines convenience with serenity. These thoughtfully curated amenities not only enhance lifestyle but also drive rental demand, higher resale value, and long-term appreciation — making Aabran Villas one of Nepal’s most compelling investment choices.

Read More: Best Apartment in Kathmandu to Buy: Exploring 3 BHK Apartments for Sale at Aabran Villas